43 us treasury coupon rate

home.treasury.gov › newsPress Releases | U.S. Department of the Treasury Interest Rate Statistics. Treasury Securities. Treasury Investor Data. Debt Management Research. ... Treasury Coupon-Issue and Corporate Bond Yield Curve. 20 Year Treasury Rate - YCharts The 20 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 20 years. The 20 year treasury yield is included on the longer end of the yield curve. The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an ...

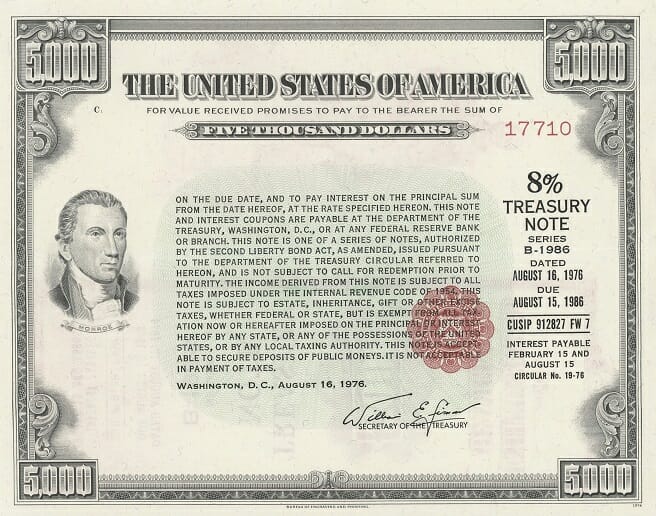

What Is a Treasury Note? How Treasury Notes Work for Beginners Treasuries pay interest in the form of coupons. The coupon rate is set before the bond gets issued and is charged every six months. What Are Treasury Yields. Treasury bonds, bills, and notes will all have varying yields. Longer-term Treasury securities typically yield higher returns than shorter-term Treasury securities. ... The United States ...

Us treasury coupon rate

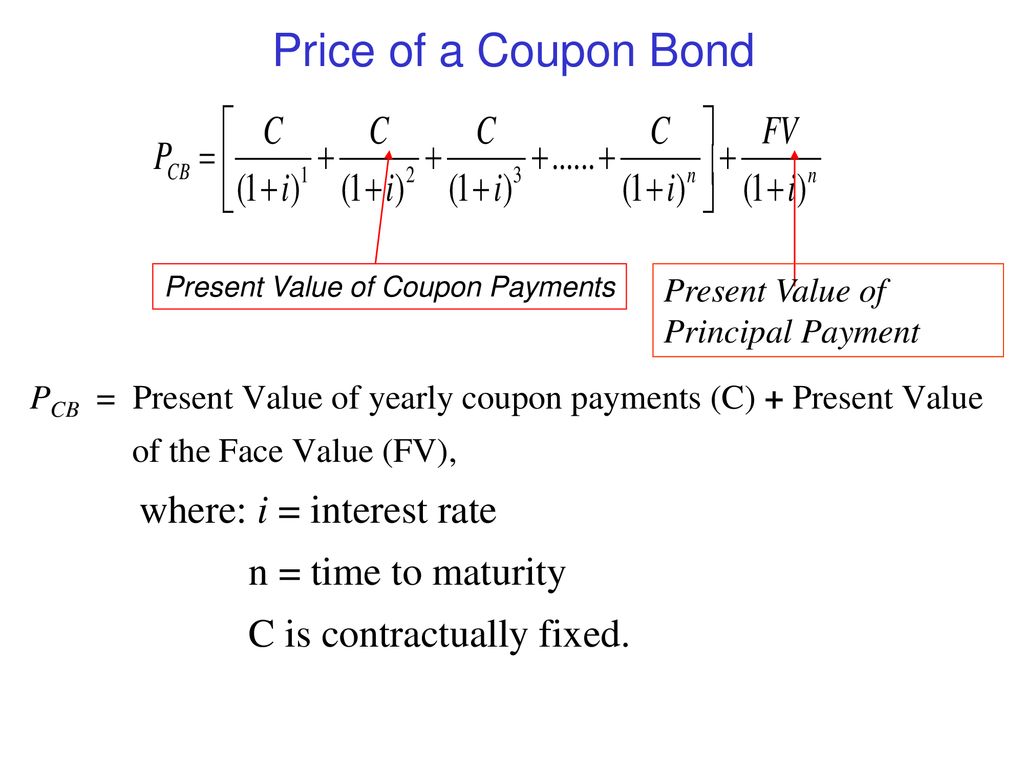

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Thus, a $1,000 bond with a coupon rate of 6% pays $60 in interest annually and a $2,000 bond with a coupon rate of 6% pays $120 in interest annually. Key Takeaways Coupon rates are the yields... Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

Us treasury coupon rate. › terms › tWhat Are Treasury Bills (T-Bills) and How Do They Work? Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ... Press Releases | U.S. Department of the Treasury Interest Rate Statistics. Treasury Securities. Treasury Investor Data. Debt Management Research. Financial Markets, Financial Institutions, and Fiscal Service. Cash and Debt Forecasting. ... Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. Receipts & Outlays. Monthly Treasury Statement. Prompt Payment: Discount Calculator - Bureau of the Fiscal Service Jun 30, 2022 · The box for current value of funds rate already has the current value. After you click Calculate, the system brings back the effective annual discount rate. For this example, with the current value of funds rate of 1% (.01), the result is .0283- … Individual - Floating Rate Notes (FRNs) - TreasuryDirect The U.S. Treasury began issuing Floating Rate Notes (FRNs) in January 2014. Issued for a term of two years, FRNs pay varying amounts of interest quarterly until maturity. Interest payments rise and fall based on discount rates in auctions of 13-week Treasury bills. We offer FRNs in TreasuryDirect and through banks and brokers.

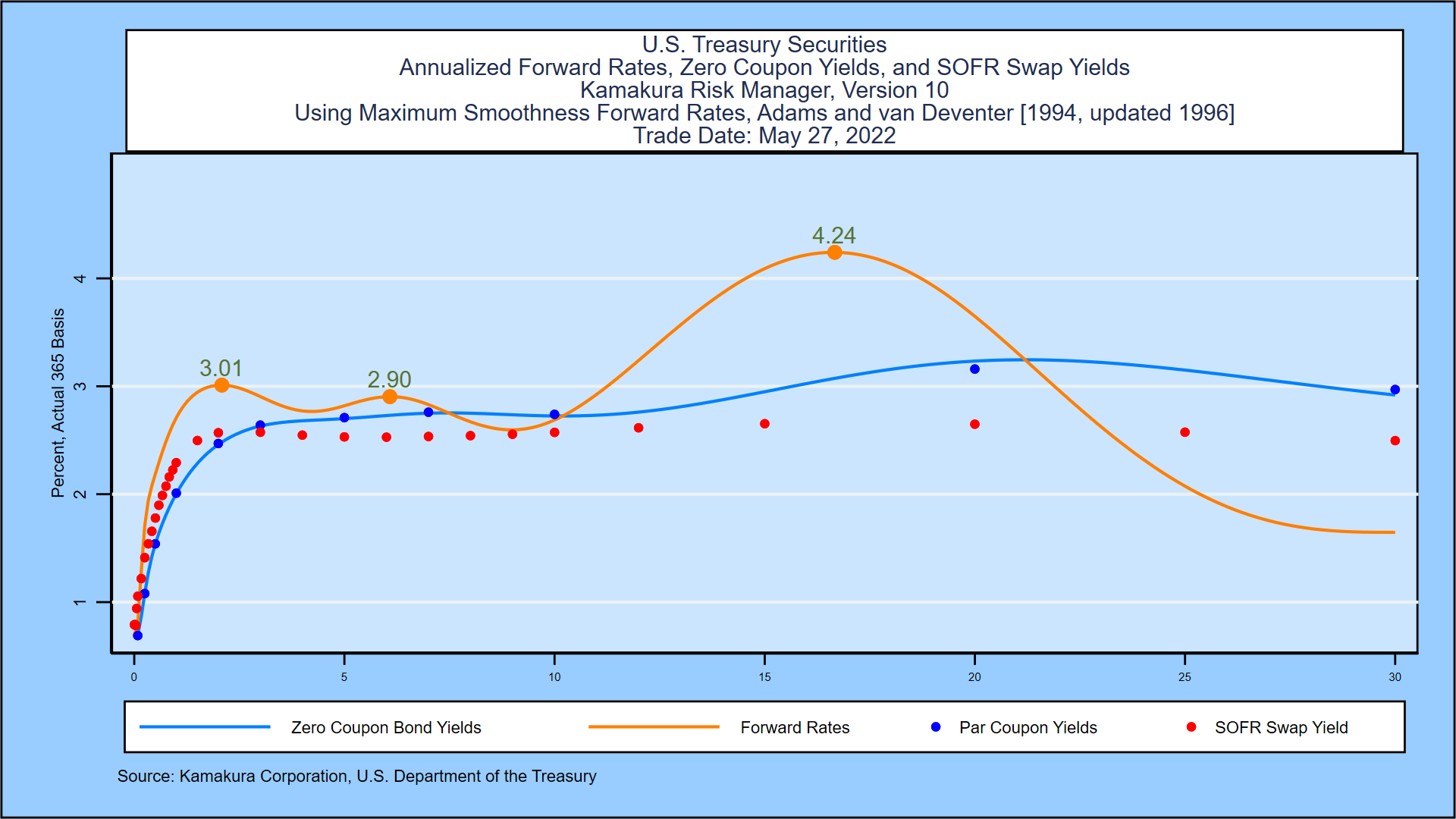

Interest Rates - U.S. Department of the Treasury The "Daily Treasury Long-Term Rates" are simply the arithmetic average of the daily closing bid yields on all outstanding fixed coupon bonds (i.e., inflation-indexed bonds are excluded) that are neither due nor callable for at least 10 years as of the date calculated. › govt › ratesGovernment - Continued Treasury Zero Coupon Spot Rates* 3.06. 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot ... › us-treasury-bondsUS Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Individual - TIPS: Rates & Terms - TreasuryDirect Multiply your inflation-adjusted principal by half the stated coupon rate on your security (i.e., 2%). The resulting number is your semi-annual interest payment. When TIPS mature, we pay either the adjusted principal or the original principal, whichever is greater. US Treasury Bonds - Fidelity US Treasury notes: $1,000: Coupon: 2-, 3-, 5-, 7-, and 10-year: Interest paid semi-annually, principal at maturity: US Treasury bonds ... (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury ... How Are Treasury Bill Interest Rates Determined? - Investopedia After the investor receives the $1,000 at the end of the 52 weeks, the interest rate earned is 2.56%, or 25 / 975 = 0.0256. The interest rate earned on a T-bill is not necessarily equal to its... US20Y: U.S. 20 Year Treasury - Stock Price, Quote and News - CNBC Get U.S. 20 Year Treasury (US20Y:Tradeweb) real-time stock quotes, news, price and financial information from CNBC.

Individual - Treasury Bonds: Rates & Terms We used to issue Treasury bonds in paper form. The last paper bonds matured in 2016. For information on paper Treasury bonds, contact us: Send an e-mail. Call 844-284-2676 (toll free) Write to: Treasury Retail Securities Services. P.O. Box 9150. Minneapolis, MN 55480-9150.

› quotes › US5YUS5Y: U.S. 5 Year Treasury - Stock Price, Quote and News - CNBC Sep 09, 2022 · 2-year Treasury yield rockets above 3.79%, highest since 2007 19 Hours Ago CNBC.com 10-year Treasury yield edges higher even as U.S. consumer inflation expectations decline September 12, 2022 CNBC.com

US5Y: U.S. 5 Year Treasury - Stock Price, Quote and News - CNBC Sep 09, 2022 · 2-year Treasury yield rockets above 3.79%, highest since 2007 19 Hours Ago CNBC.com 10-year Treasury yield edges higher even as U.S. consumer inflation expectations decline September 12, 2022 CNBC.com

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia Aug 29, 2022 · This is known as the coupon rate. For example, a $10,000 T-bond with a 5% coupon will pay out $500 annually, regardless of what price the bond is trading for in the market. Factors Affecting ...

Government - Continued Treasury Zero Coupon Spot Rates* Aug 14, 2013 · *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model.

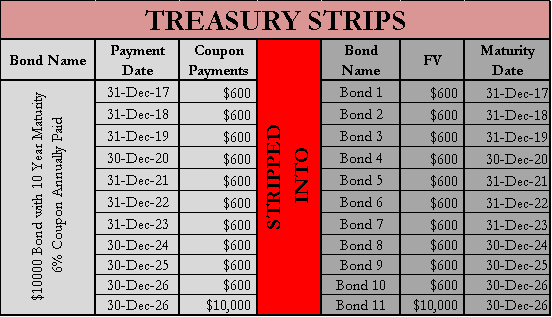

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds can move up significantly when the Fed cuts rates aggressively. 1 These gains can more than offset stock related losses, so Treasury zeros are often an excellent...

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors

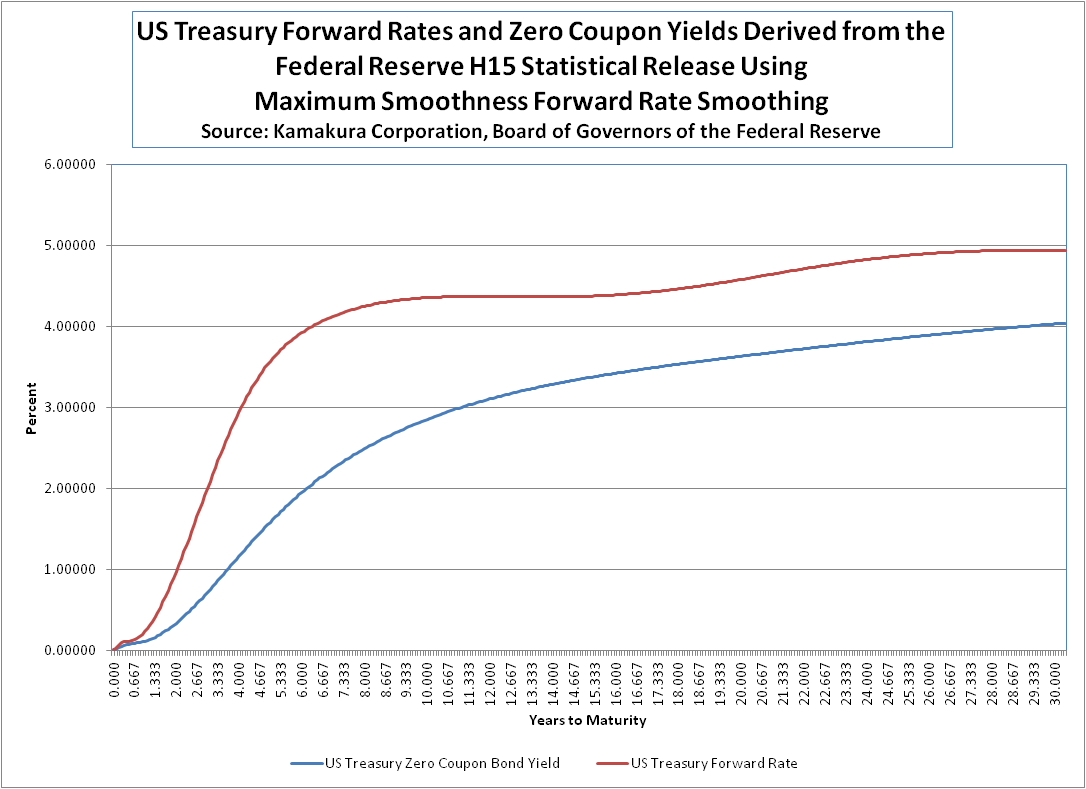

US Treasury Zero-Coupon Yield Curve - NASDAQ US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,686 datasets) Refreshed 13 hours ago, on 8 Sep 2022 Frequency daily Description These yield curves...

United States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month ...

› ask › answersHow Is the Interest Rate on a Treasury Bond Determined? Aug 29, 2022 · This is known as the coupon rate. For example, a $10,000 T-bond with a 5% coupon will pay out $500 annually, regardless of what price the bond is trading for in the market. Factors Affecting ...

NJ Pensions and Benefits - Contact Us - Government of New Jersey Sep 13, 2022 · Department of the Treasury Division of Pensions & Benefits PO Box 295 Trenton, NJ 08625-0295

US30Y: U.S. 30 Year Treasury - Stock Price, Quote and News - CNBC Yield Open 3.492% Yield Day High 3.544% Yield Day Low 3.466% Yield Prev Close 3.508% Price 90.9844 Price Change +0.3594 Price Change % +0.3984% Price Prev Close 90.625 Price Day High 91.3594 Price...

› markets › rates-bondsUnited States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month ...

Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions .)

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Thus, a $1,000 bond with a coupon rate of 6% pays $60 in interest annually and a $2,000 bond with a coupon rate of 6% pays $120 in interest annually. Key Takeaways Coupon rates are the yields...

![Zero-Coupon Bond: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/28183250/Zero-Coupon-Bonds-Formula-960x325.jpg)

/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

![Yield to Maturity (YTM): Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/19095826/Yield-to-Maturity-YTM-Formula.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

:max_bytes(150000):strip_icc()/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)

/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

Post a Comment for "43 us treasury coupon rate"