45 zero coupon bonds duration

Bond Duration Flashcards | Quizlet Duration • Duration is the term for the effective maturity of a bond • Time value of money tells us we must calculate the present value of each of the eight zero coupon bonds to construct an average • We then need to take the present value of each zero and divide it by the price of the coupon bond. Bond Duration Calculator - Macaulay and Modified Duration ... From the series, you can see that a zero coupon bond has a duration equal to it's time to maturity - it only pays out at maturity. Example: Compute the Macaulay Duration for a Bond. Let's compute the Macaulay duration for a bond with the following stats: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to Maturity: 6.5% ...

Bond duration - Wikipedia For a standard bond, the Macaulay duration will be between 0 and the maturity of the bond. It is equal to the maturity if and only if the bond is a zero-coupon bond. Modified duration, on the other hand, is a mathematical derivative (rate of change) of price and measures the percentage rate of change of price with respect to yield.

Zero coupon bonds duration

Solved A zero-coupon bond has a duration equal to its ... A zero-coupon bond has a duration equal to its maturity. (True/False) Select one: O True False Duration is a useful number because it combines the effects of maturity, coupon and market rates to indicate ho (True/False) Select one: True O False High coupon bonds will usually have higher durations than low coupon bonds of the same maturity. What is the duration of a zero coupon bond? - Quora Originally Answered: what is the duration of a zero coupon bond? Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Zero coupon bonds duration. Modified Duration - Zero Coupon Bond Modified Duration ... Zero-coupon bonds are popular (in exams) due to their computational convenience. We barely need a calculator to find the modified duration of this 3-year, zero-coupon bond. Its Macaulay duration is 3.0 years such that its modified duration is 2.941 = 3.0/ (1+0.04/2) under semi-annually compounded yield of 4.0%. Macaulay's Duration | Formula | Example Duration of Bond A is 4.5, i.e. the maturity period (in years) of the zero-coupon bond. Duration of Bond B is calculated by first finding the present value of each of the annual coupons and maturity value. Annual coupon is $50 (i.e. 5% of the $1,000) and the maturity value is $1,000. Zero-coupon bond - Wikipedia Zero coupon bonds have a duration equal to the bond's time to maturity, which makes them sensitive to any changes in the interest rates. Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments. Macaulay Duration - Overview, How To Calculate, Factors A zero-coupon bond assumes the highest Macaulay duration compared with coupon bonds, assuming other features are the same. It is equal to the maturity for a zero-coupon bond Zero-Coupon Bond A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value.

Duration and convexity of zero-coupon convertible bonds ... Figure 1a-d show the above convertible duration, D CB, for four different sets of parameter values.For comparison, we have also shown the duration of the following: 1) a default-free zero-coupon bond with the same maturity; 2) a corporate bond with exactly the same details (face value, maturity, etc.), except that it is non-convertible; and 3) a convertible bond using the Calamos (1988 ... PDF Duration - New York University Duration 7 For zero-coupon bonds, there is an explicit formula relating the zero price to the zero rate. We use this price-rate formula to get a formula for dollar duration. Of course, with a zero, the ability to approximate price change is not so important, because it's easy to do the exact calculation. A zero coupon bond has a duration equal to its maturity ... You have a 15-year maturity, 4% coupon, 6% yield bond with duration of 10.5 years and a convexity of 128.75. The bond is currently priced at $805.76. If the interest rate were to increase 200 basis points, your predicted new price for the bond (including convexity) is _________. You have a 25-year maturity, 10% coupon, 10% yield bond with a ... The Macaulay Duration of a Zero-Coupon Bond in Excel ... To compensate for the lack of coupon payment, a zero-coupon bond typically trades at a discount, enabling traders and investors to profit at its maturity date, when the bond is redeemed at its face value. The Formula For Macaulay Duration Macaulay Duration = ∑ i n t i × P V i V where: t i = The time until the i th cash flow from the asset will be

The duration of a zero coupon bond is equal to the ... The duration of a zero-coupon bond is equal to the maturity of that bond. For example, suppose we have a zero-coupon bond with 2 years to maturity trading at a YTM of 25%. If you calculate the duration you will find that it will be equal to two years. 3.7.4. Duration of an irredeemable bond. An irredeemable bond is a perpetuity. Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. duration of zero coupon bonds | Forum | Bionic Turtle With respect to a zero coupon bond, Macaulay duration = maturity, and therefore must be a monotonically increasing function of maturity. On the other hand, DV01 of a zero (or deeply discounted) is not strictly increasing as DV01 = P*D/10,000 and the numerator has offsetting effects. If you'd kindly reference, I can fix? Thanks! Apr 7, 2012 #3 S PDF APPENDIX 3A: Duration and Immunization maturity and duration zero-coupon bond or a coupon bond with a five-year duration, the FI would produce a $1,469 cash flow in five years, no matter what happens to interest rates in the immediate future. Next we consider the two strategies: buying five-year deep-discount bonds and buying five-year duration coupon bonds.

Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and...

The Macaulay Duration of a Zero-Coupon Bond in Excel Calculating the Macauley Duration in Excel Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In columns A and...

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

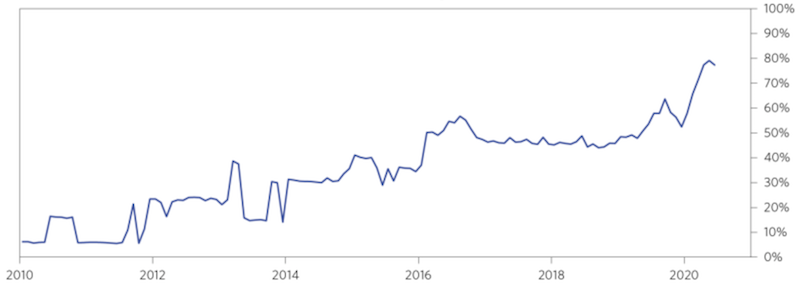

Zero Duration ETF List - ETFdb.com zero duration and all other bond durations are ranked based on their aggregate 3-month fund flows for all u.s.-listed bond etfs that are classified by etf database as being mostly exposed to those respective bond durations. 3-month fund flows is a metric that can be used to gauge the perceived popularity amongst investors of zero duration …

PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to maturity formula zero ...](https://i.ytimg.com/vi/69R6CrIUZ0k/hqdefault.jpg)

[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to maturity formula zero ...

What Is Duration of a Bond? - TheStreet Definition - TheStreet The easiest duration to calculate is that of a zero-coupon bond. This bond has zero yield, which means it does not pay any interest. Its duration is equal to its time to maturity. When a coupon is...

Zero Coupon Bond Calculator - MiniWebtool The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face value.

portfolio of zero coupon bonds and combine it with the ... portfolio of zero coupon bonds, and combine it with the duration of a zero-spread floating rate bond to find the duration for the whole bond) Therefore, the duration of portfolio B is DB = 0.5×Dz + 0.5×Dfl = 0.5×2 + 0.5×0.5 = 1.25 For the risk-averse investor, portfolio B should be recommended since it has lower riskas measured by DA > DB. Q5.

Post a Comment for "45 zero coupon bonds duration"